The new title of my substack is “Ponzinomics”. Not to toot my own horn, but I think it’s a pretty cool name for a blog mainly focused around crypto. Ponzi schemes are the dark arts of economics, but they are an interesting way to generate value from nothing. The simple Ponzi scheme is an economic construction that really hasn’t had much study or innovation since its first rendition.

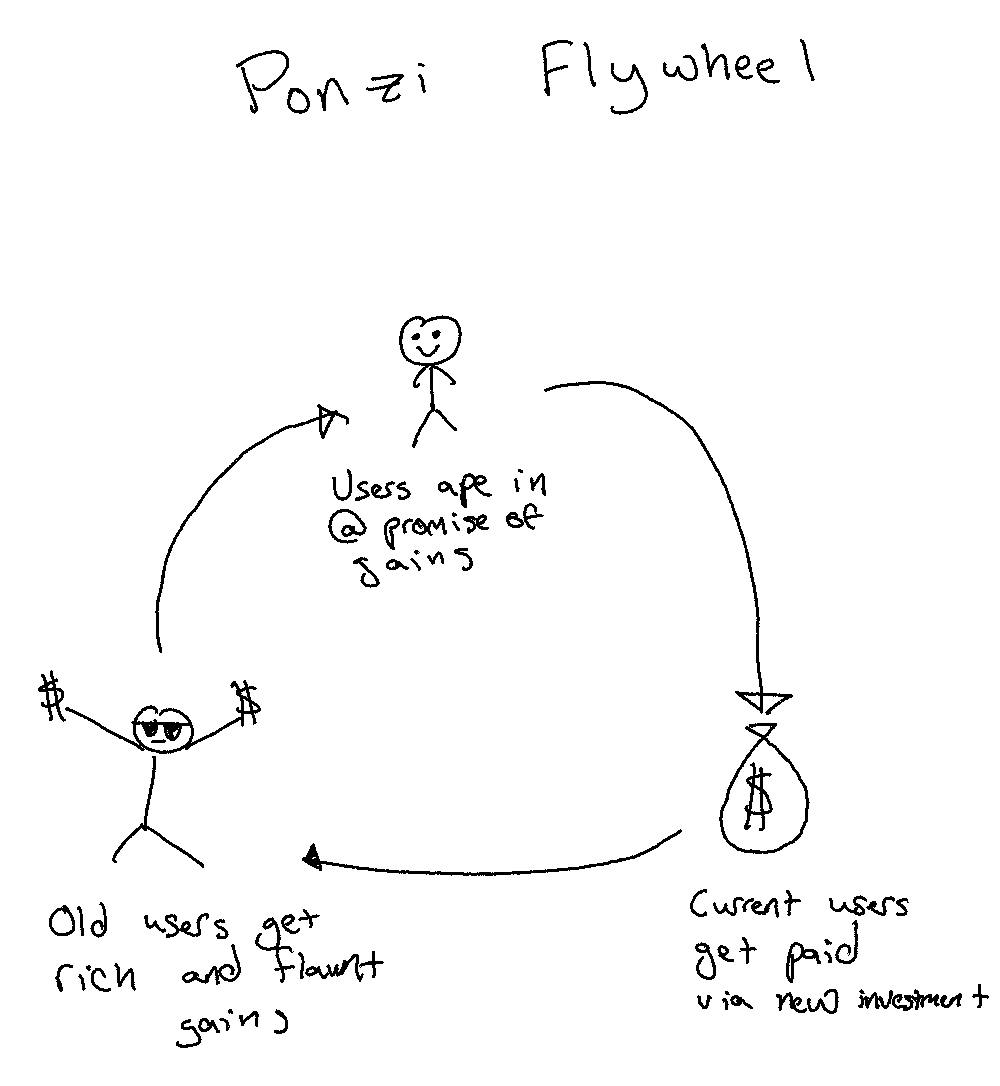

The flywheel is pretty simple — users enter the scheme with an investment. This investment is used to pay users that have been there previously. These users then flaunt the fact that they are getting insane returns, and this in turn gets new users to ape in and keep the flywheel running.

The problem with the traditional Ponzi scheme is it relies on fraud. The investors usually don’t know that they are really just giving their investment to parties that got in first. That’s why when the curtain falls and everyone realizes they are in a Ponzi scheme, the whole thing collapses. And people go to jail.

But what if the entire construction is transparent from the start? If there is no fraud involved, what’s the problem? There isn’t, except the traditional ‘Ponzi Scheme’ is to bland and derivative. It isn’t really doing anything except enriching original investors.

However, I think things like flywheels can be important to seed liquidity in order to create new systems. How do you create value when there wasn’t value before? How do you get people to start using new weird constructions such as Defi? The problem with new economic aparatus is that it requires a critical mass before becoming self sustaining.

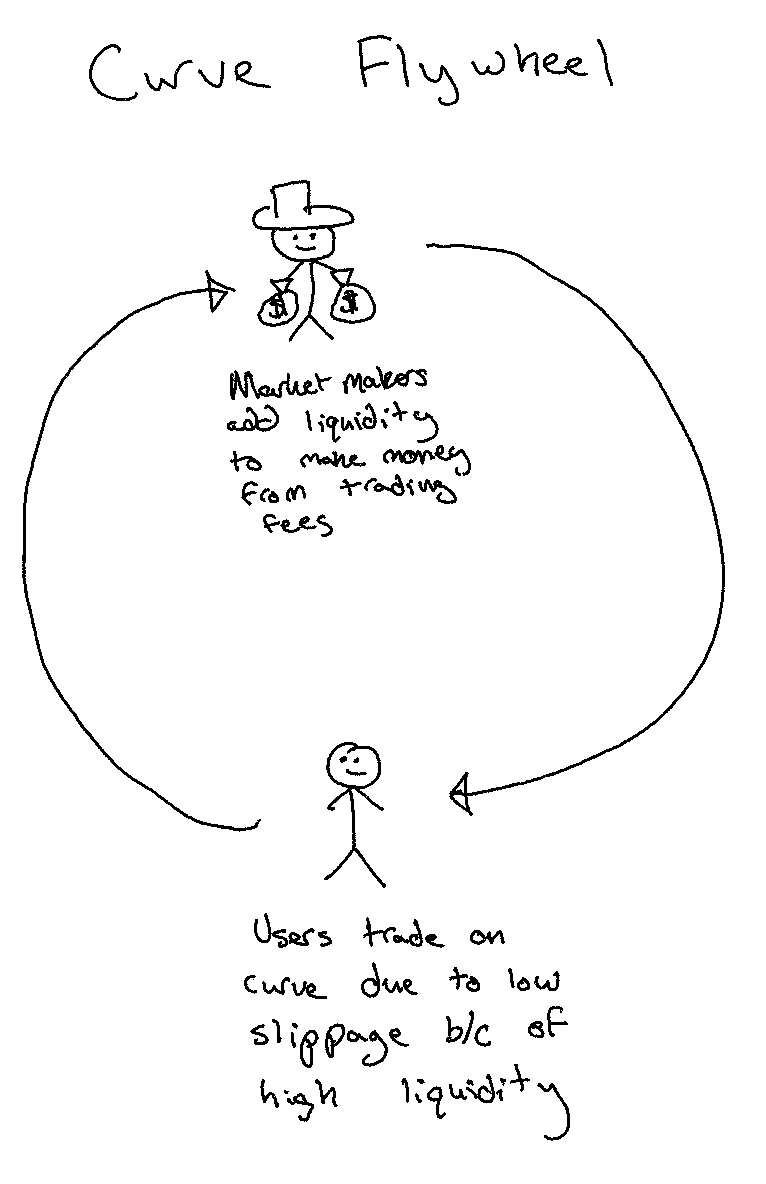

Theoretically, market makers provide liquidity to something like Curve Finance to gain value from trading fees. Users will use Curve to trade due to deep liquidity providing low slippage.

However if no usage of Curve (which there will be if there is no liquidity), then no fees will be generated. It’s the chicken and the egg problem all over again. How can you get something like this started? You can merely pay market makers to provide liquidity, but thats a one time thing. What if they leave afterwards?

A better solution is Ponzinomics. Curve has a token (CRV) that receives a cut of all trading fees. To earn this token, you need to provide liquidity to curve. More CRV is given out to early adopter than later ones (based on an emission schedule).

This incentivizes early adopters to ape in and seed liquidity, due to promises of future riches. Once there is enough liquidity, the normal self sustaining CRV flywheel can finally function.

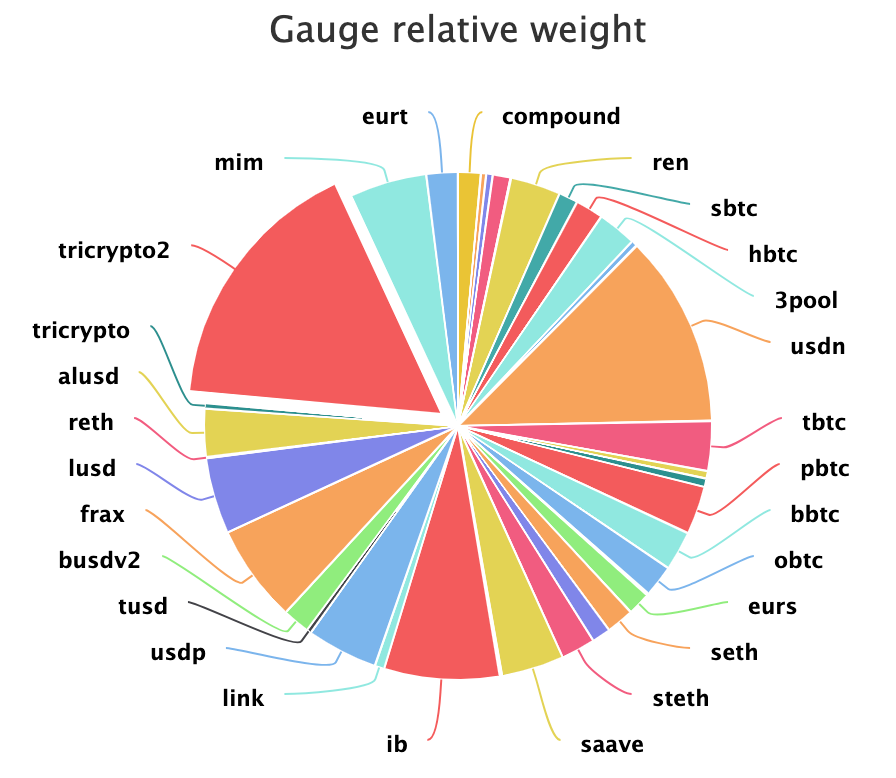

One problem with Curve rewards, is that prior to curve becoming self sustaining, the CRV cut of trading fees is negligible. It relies a bit on hype towards future rewards. However Curve is cool because the incentives don’t stop there. If you have more curve, you can also vote to ensure you receive a larger sale of future curve rewards. This in turn increases demand for the CRV, which thus increases the market makers willing to add liquidity.

The original Ponzi scheme hasn’t changed much in the past hundred years, but in crypto people are coming up with new constructions that are genuinely interesting, don’t rely on fraud, and serve a purpose (seed the new financial system). I want to talk about these and maybe come up with some new constructions myself.

This is why I choose the title ‘Ponzinomics’. Crypto utilizes the dark arts of economics (game theory, flywheels, hype, etc) in order to create things we haven’t seen before